This project was purely a learning experiment and did not result in any financial gains. Trading is a highly risky and complex field, and the aim of this article is not to provide any trading advice or endorse trading as a means of making profits. Please trade responsibly.

Introduction

In the era of peak cryptocurrency interest, my colleague Ivan Bianchi and I embarked on a learning journey into the world of economics and trading. Our curiosity led us to create the Trading Crypto Bot—a Java-based automated trading system focusing on Ethereum and its family of altcoins. The project aimed to delve deep into the mechanics of trading platforms, various algorithms, and real-time market analysis. Although the system did not generate positive returns, the educational payoff was immeasurable.

Technologies Used

- Backend: Java

- Trading API: Binance API

- Frontend: Angular2

- Data Analysis: Various in-house and public algorithms

Project Goals

- Gain a comprehensive understanding of trading mechanisms, including buy/sell orders, stop-loss, and fees.

- Experiment with various trading algorithms, ranging from heuristic-based methods to complex chaos systems.

- Simulate trading strategies on historical data to evaluate performance.

Challenges Faced

- Market Volatility: Navigating a highly unpredictable cryptocurrency market.

- Algorithmic Complexity: Developing and testing various algorithms in real-time.

- Financial Risks: Operating in an environment where real money was at stake.

Solutions and Approaches

- Simulation Mode: Employed a simulation mode to evaluate the potential impact of our algorithms on years of market data.

- Algorithm Swapping: Implemented the ability to swap algorithms in real-time based on market behavior.

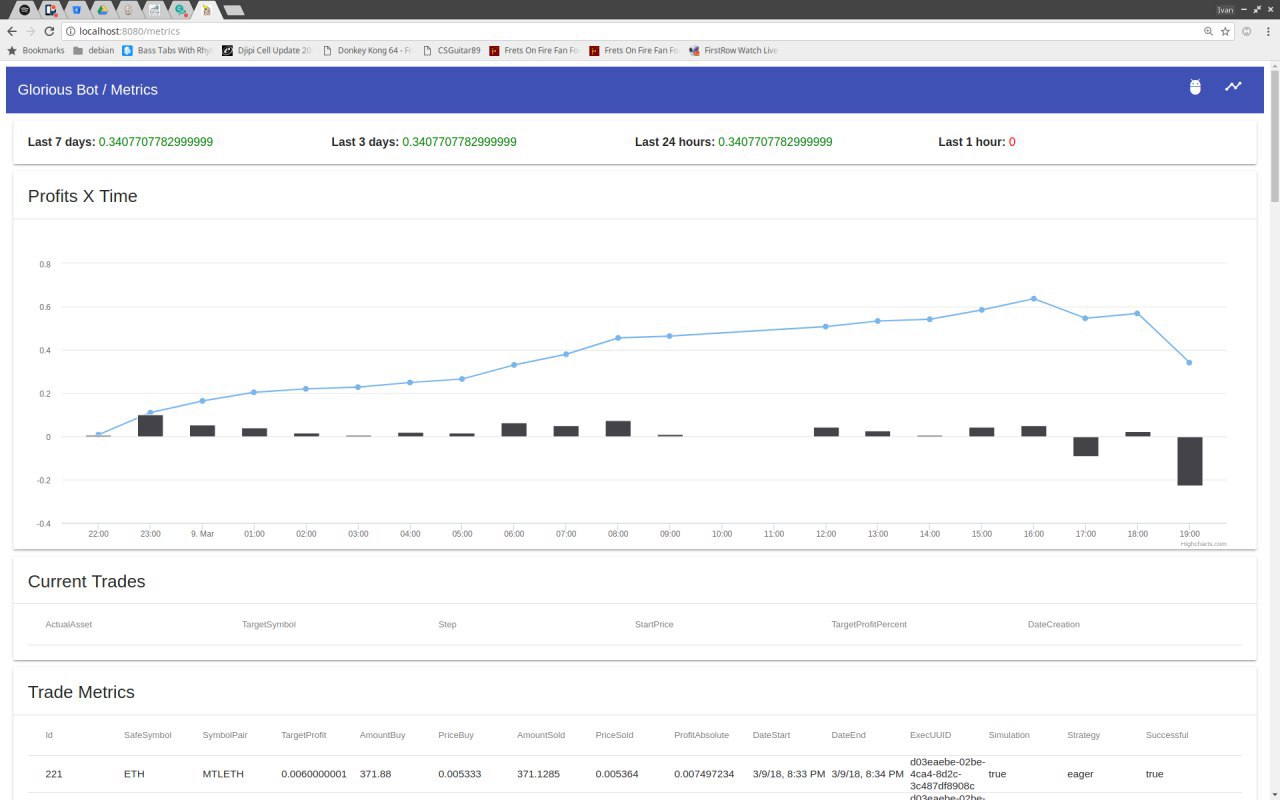

- Real-time Monitoring: Used an Angular2 frontend to track performance and manually intervene if needed.

Key Features

- Algorithm Diversity: From heuristic-based trading to chaos systems, the bot was capable of running a range of algorithms.

- Real-time Dashboard: A frontend dashboard to monitor performance and make immediate changes to trading orders.

- Market Simulation: Could simulate years of market data to predict algorithmic performance.

Outcomes and Impact

- Educational Value: We gained a deep understanding of trading principles, strategies, and the mechanics of a trading system.

- Risk Management: Learned invaluable lessons about managing financial risks in a highly volatile market.

- Financial Outcome: Despite the negative 2% return, the project served as a crucial learning experiment in the field of trading.

Lessons Learned

- Market Sensitivity: Trading algorithms are only as good as the market conditions they operate in.

- Risk and Reward: The project reinforced the inherent risks involved in trading, particularly in volatile markets like cryptocurrencies.

- The House Always Win: At the end, more trades means more fees, and more fees more money to the exchange. Intraday trading is a very lucrative business for the exchange.

Future Directions

- Machine Learning: In a different market climate, exploring machine learning algorithms to predict market behavior could be an interesting avenue.

- Asset Diversification: Experimenting with a wider range of assets beyond Ethereum and its altcoins.

Acknowledgments

Special thanks to Ivan Bianchi for being an invaluable partner in this project. Our collaborative effort made this complex adventure a highly educational experience.